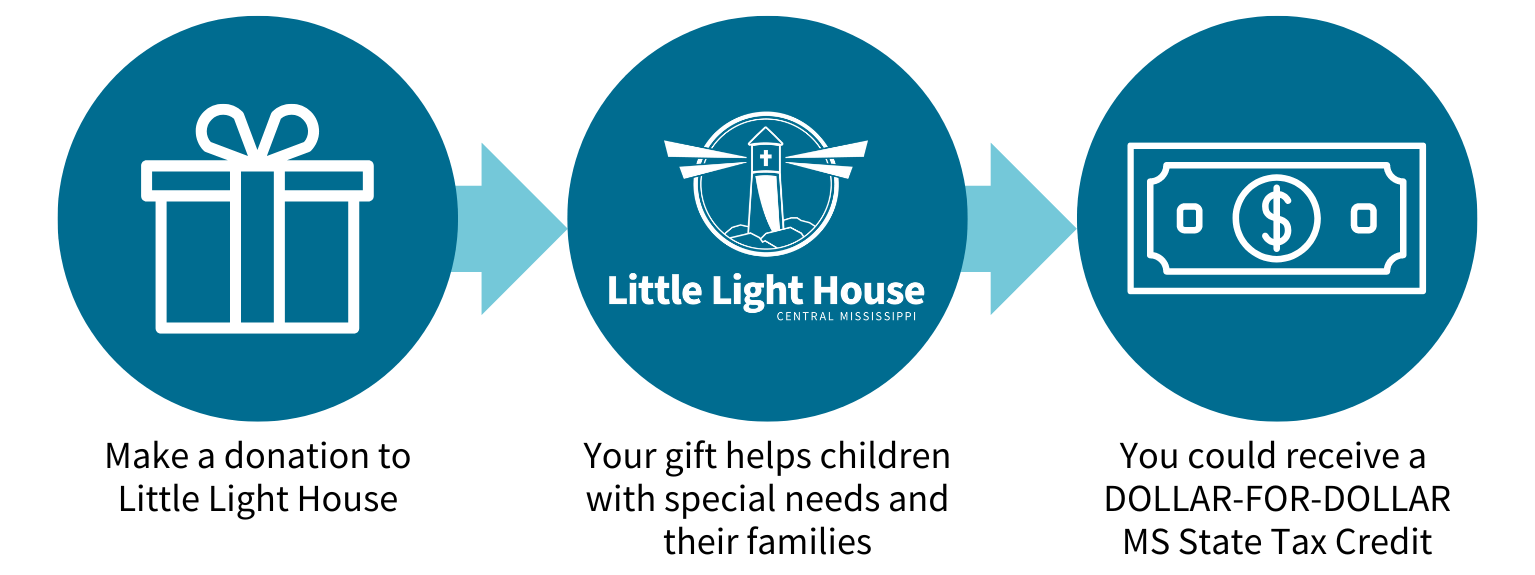

Reduce Your State Tax Liability, & Change Lives at the Same Time!

The Children's Promise Act tax credit provides a dollar-for-dollar tax credit for donations to Little Light House (monetary donations ONLY). Businesses and individuals can allocate tax dollars to Little Light House.

You have a choice. You can impact the lives of children with special needs by giving your tax dollars to Little Light House, or you can give your tax dollars to the government. This requires no additional money out of your pocket. There is no risk because you can apply and be approved for the tax credits before donating.

Donate As:

This is not tax advice. You should contact your tax professional for advice on how this tax credit can benefit you.

|

Don’t miss the latest news:

|

Little Light House Central Mississippi is a 501 (c) 3 non-profit Christian Developmental Center for children with special needs, age birth through six years of age. All gifts to Little Light House Central Mississippi are tax-deductible, less goods and services received.

NOTICE OF NONDISCRIMINATORY POLICY AS TO STUDENTS: Little Light House-Central Mississippi is a non-profit Christian Developmental Center for children with special needs, birth through six years of age. The Little Light House does not discriminate on the basis of religion, race, color, sex, national or ethnic origin, or medical diagnosis (unless it affects the child’s ability to attend on a regular basis) in the administration of its educational policies, admissions policies, and other school programs. Some behavioral conditions may be evaluated on an individual basis. Little Light House assures that all children’s records will be maintained as confidential.

NOTICE OF NONDISCRIMINATORY POLICY AS TO STUDENTS: Little Light House-Central Mississippi is a non-profit Christian Developmental Center for children with special needs, birth through six years of age. The Little Light House does not discriminate on the basis of religion, race, color, sex, national or ethnic origin, or medical diagnosis (unless it affects the child’s ability to attend on a regular basis) in the administration of its educational policies, admissions policies, and other school programs. Some behavioral conditions may be evaluated on an individual basis. Little Light House assures that all children’s records will be maintained as confidential.